Companies may generate cash by borrowing money or through other cash inflows, such as selling off assets or reducing its labor force, while posting a net loss for a certain reporting period. The cash that it brings in is able to offset any losses it may have during that period. Although DCF is a popular method that is widely used on companies with negative earnings, the problem lies in its complexity.

- Negative retained earnings appear as a debit balance in the retained earnings account, rather than the credit balance that normally appears for a profitable company.

- A negative balance in the retained earnings account is called an accumulated deficit.

- As a result, the firm will be less able to pay a dividend than before the purchase was accomplished.

- Now, you must remember that stock dividends do not result in the outflow of cash, in fact, what the company gives to its shareholders is an increased number of shares.

How Companies Use Retained Earnings

This document calculates net income, which you’ll need to calculate your retained earnings balance later. A history of lower retained earnings could indicate that the company is in a mature, low-growth stage since there are fewer ways for the company to reinvest its earnings. This may indicate that the company doesn’t need to invest very much additional capital to continue to be profitable, which often means the extra funds are distributed to shareholders through dividends. If your company pays dividends, you subtract the amount of dividends your company pays out of your retained earnings. Let’s say your company’s dividend policy is to pay 50 percent of its net income out to its investors.

What Does It Mean for a Company to Have High Retained Earnings?

This can make a business more appealing to investors who are seeking long-term value and a return on their investment. When a company generates net income, it is typically recorded as a credit to the retained earnings account, increasing the balance. In contrast, when a company suffers a net loss or pays dividends, the retained earnings account is debited, reducing the balance. Net profit refers to the total revenue generated by a company minus all expenses, taxes, and other costs incurred during a given accounting period. Revenue, net profit, and retained earnings are terms frequently used on a company’s balance sheet, but it’s important to understand their differences. When a company consistently experiences net losses, those losses deplete its retained earnings.

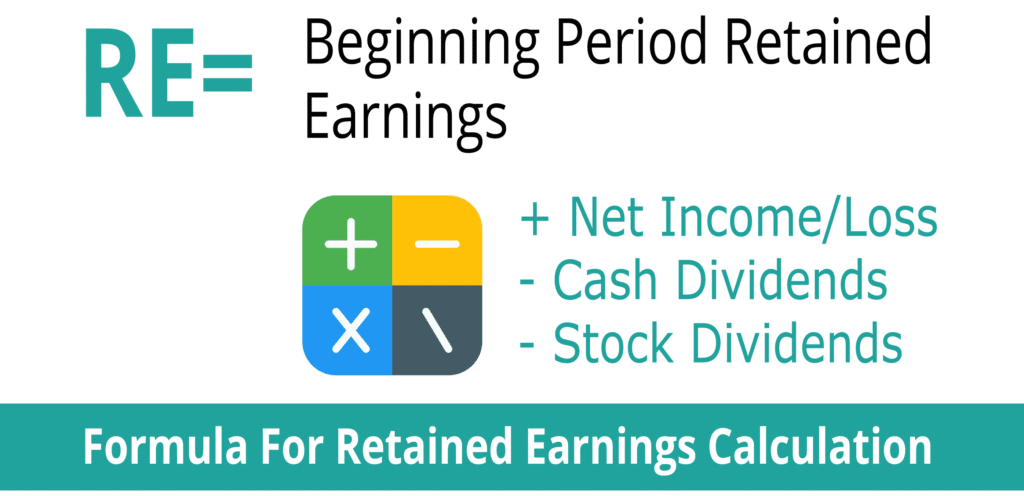

Retained Earnings Formula

As a result, each shareholder has additional shares after the stock dividends are declared, but their stake remains the same. Since cash dividends result in an outflow of cash, the cash account on the asset negative retained earnings side of the balance sheet will get reduced by $100,000. This outflow of cash would also lead to a reduction in the retained earnings of the company as dividends are paid out of retained earnings.

It can also be an essential factor in a company’s creditworthiness, demonstrating its ability to generate profits and set them aside for future use. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance. This is the amount of retained earnings to date, which is accumulated earnings of the company since its inception.

Retained earnings are net income (profits) that a company saves for future use or reinvests back into company operations. You should report retained earnings as part of shareholders’ equity on the balance sheet. Retained earnings refer to the portion of a company’s profits that are reinvested back into the business, rather than being distributed to shareholders. Over time, retained earnings can have a significant impact on a company’s growth and profitability. Retained earnings are affected by an increase or decrease in the net income and amount of dividends paid to the stockholders. Thus, any item that leads to an increase or decrease in the net income would impact the retained earnings balance.

One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value. It is calculated over a period of time (usually a couple of years) and assesses the change in stock price against the net earnings retained by the company. When a company has negative retained earnings, it means that the company’s losses are more significant than its accumulated profits. This can concern investors and creditors, as it may indicate that the company is in financial distress. Alternately, dividends are cash or stock payments that a company makes to its shareholders out of profits or reserves, typically on a quarterly or annual basis.

You forecast the FCF will grow 5% annually for the next five years and assign a terminal value multiple of 10 to its year five FCF of $25.52 million. At a discount rate of 10%, the present value of these cash flows (including the terminal value of $255.25 million) is $245.66 million. If the company has 50 million shares outstanding, each share would be worth $4.91 or $245.66 million ÷ 50 million shares. There are some limitations with retained earnings, as these figures alone don’t provide enough material information about the company. For example, if a company declares a stock dividend of 10%, meaning the company would have to issue 0.10 shares for each share held by the existing stockholders.